31 Jan 2016

By Belle

How I'm curbing my spending in 2016

I’ve been spending too much money lately (actually, for a lot longer than “lately”). Shopping is a habit I fall back on when I’m bored. It’s interesting and exciting to have new things to play with.

I really need to get my spending under control this year, since I no longer have a full-time job and my freelance income hasn’t grown enough to replace the income I’ve become accustomed to. I’m trying to diversify my income by producing some products as well as doing freelance client work, but I also want to get better at saving money and not spending so much.

When I made a list of big goals for 2016, almost all of them related to making or saving money. I want to work hard on improving my financial situation this year, so that next year I can comfortably explore projects like moving house, spending more time on work I enjoy, and travelling.

Curbing my spending is just one part of my financial focus, but it’s an important one. I had a few ideas about how to improve my spending habits this year, but I also did some research to see what personal finance experts have to say about cutting back on spending.

One comment I came across from Martin the “Money Saving Expert” really made it obvious where my main issue is:

You have to start letting your finances rule your lifestyle, not vice-versa.

Rather than trying to get what I want based on the money I have, this blog post suggested I figure out “On my paltry salary, what’s the best lifestyle I can possibly have?”. Although I prefer the idea of deciding what I want, then figuring out how to pay for it, I expect people who are good at saving money (or at least, at not spending much) think about their finances this way.

I also picked up some tips for thinking about purchase decisions from my research. Here are a few I think would help me curb my spending:

Examine the opportunity cost

Jenny from Money Saving Expert suggests assessing each purchase in terms of how much I’ll use the item:

…in other words, could you get better use or pleasure out of the same cash buying something else? So is a stunning £300 dress that’ll be used once worth it, if the same money could buy other items used more often?

Sleep on it

A common idea is to wait out a cool-down period before making a purchase. I try to use this approach already, but it wouldn’t hurt to enforce it a little more.

Compare the worth to your debt/savings

Another tip from Jenny at Money Saving Expert is to consider how much longer it’ll take to pay off your debt or hit your savings goal if you make a particular purchase. This is one that could be quite powerful for me, as I have a debt I’m working through right now, and I’m hoping to travel more this year and next. Both goals are important to me, and would add context to the decision of purchasing something now, if I take into account how much further I’m pushing back those goals by doing so.

Sell old things to make room for the new

Something I haven’t been very good at in the past is selling my used items when I replace them. This year I want to be more consistent in selling off (or giving away if necessary) anything I’m not using anymore. This way I’ll cover some of the cost of purchasing new items, plus I’ll stop gathering clutter that I don’t need.

Pay yourself pocket money

I both love and hate this idea (another one from Jenny). After making sure the bills are covered, the idea is to dole out a certain amount of pocket money per week or month to spend as I like. This obviously means if I want to purchase something bigger, I’d need to literally save up my pocket money over time.

I hate the idea of having to wait months to purchase something if the money for it is in my account already, but I also think this would be a great way to curb my spending. Even if I wanted to purchase something that my pocket money covered, I’d think twice about it if it meant using up my whole allowance for the week or month.

Choose spending days ahead of time

Another suggestion from Jenny is to choose one or two days a week as “no spend” days, where no shopping is allowed. Spending on bills and essentials is fine, but shopping has to be put off until another day.

If I use this method, I think I’ll switch it around so I can only shop on one or two days of the week. That means if I want to buy something I’m forced into a cool-off period if today isn’t a shopping day.

Make need, want, and wish lists

An idea I picked up from Mihir Patkar at MakeUseOf is to create three separate shopping lists:

- NEED: for items you need to buy or replace

- WANT: for items you’ll buy once you have enough money

- WISH: for items you’d like to have but can’t afford

Then, when shopping, nothing on the want list can be purchased until everything on the need list is crossed off. And nothing on the wish list can be bought until the want list is all done.

This approach would take a lot of discipline, especially if there are cheaper items on the want list than on the need list, but I think it encourages more healthy spending.

Spend a little, save a little

Another tip from Mihir that I like a lot is to save 10% of every purchase you make into a separate savings account. So if you buy something that costs $200, for instance, you then put $20 into your savings account. Not only does this help increase savings over time, but it adds a 10% surcharge to the purchase price of everything you want to buy, effectively.

Stop spending $5 notes

Arti Patel suggests in a Huffington Post article to choose a type of currency—for example, $5 notes—and to never spend them. “Instead stash them away in a jar or drawer and watch your stash grow and grow,” says Arti.

Based on these ideas and the rest of my research, here are my plans for the year to keep this bad habit under control:

1. Making rules for spending

In an attempt to reign myself in, I’ve set up very specific rules about what I can spend money on. Anything under $99 is not considered a “big expense”, so I just need to make sure I can afford to spend the money.

Anything over $99 is a big expense, and is subject to the following rules:

- I must be able to comfortably afford to spend the money.

- The expense must directly relate to one of my 6 yearly goals.

I listed my goals in my 2015 review post, but for a quick recap they were:

- Double Hello Code revenue

- Release 4 of my own products

- Pay off my tax debt

- Launch Field Trip (my online magazine)

- Find a sport or exercise I enjoy

- Travel to Europe

You can see that for some of these goals (pay off tax debt, double Hello Code revenue) it’ll be hard to justify any related expenses. I may have expenses for sporting or exercise equipment, or for anything that will help me get my own products created and launched. Travelling to Europe will also come with expenses, obviously, but that goal is only likely to come to fruition if all the other goals are already completed.

I’m hoping these rules will make it easier to avoid big purchases and keep myself focused on my goals for the year.

I’ve already bumped up against the restrictions, as my iPad Mini is so old that it’s really struggling to keep up with anything I ask of it. I’ve decided to sell it, but I can’t plan to buy a new one this year, as it will cost several hundred dollars, and isn’t directly related to any of my goals… unless I decide to build an iPad app as one of my four products for the year. But no, I probably won’t do that.

2. Finding other ways to deal with boredom

As I said, boredom is one main reason I turn to shopping. I enjoy the novelty of having new things.

An obvious way to fail at this project would be to create strict rules to stop my spending, but not give myself an alternative for dealing with boredom. Finding alternatives to shopping that captivate my attention long enough to help me avoid spending money is a work-in-progress.

For now, I have a few ideas to try out:

- Cycling: I got a bike recently, so this will be a novelty for a while.

- Badminton: This is the first sport I want to try as an attempt to reach the goal of finding a sport or exercise I enjoy this year.

- Writing more: I’ve been writing a lot lately, and I’m enjoying the feeling of publishing more regularly.

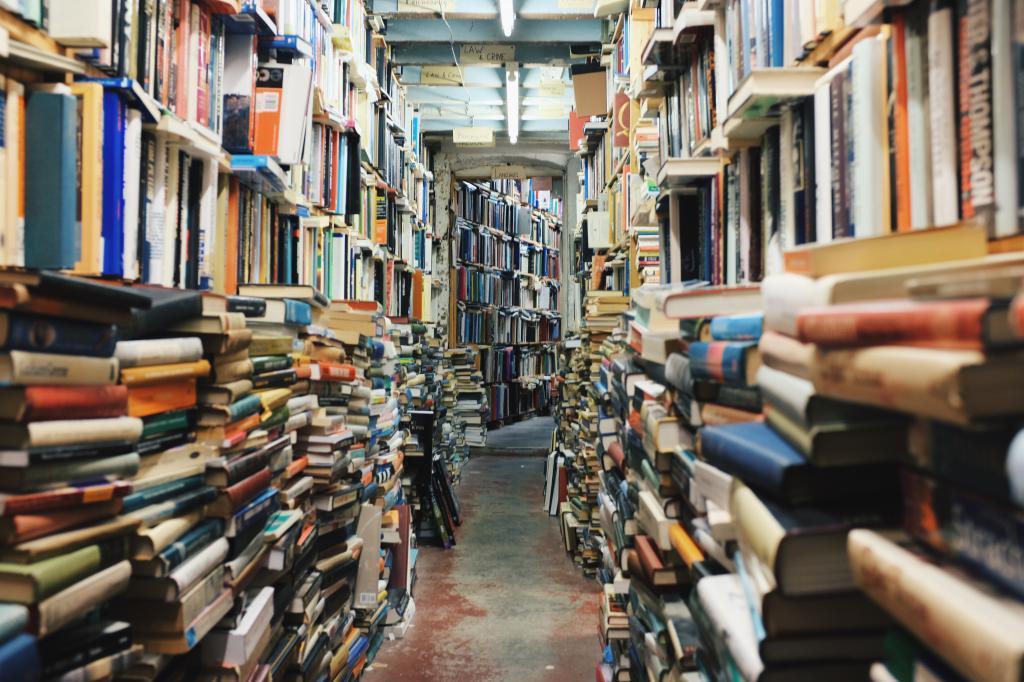

- Reading more: I’m not very good at picking up a book when I’m bored, but once I’m into a good book it’s fairly easy to keep reading.

- Playing games: I like playing board games but haven’t done it for a while, so I want to try this as a boredom-buster.

- Playing piano: This is something I want to do more often this year, so using it as a boredom-buster would be a good start.

- Building new projects: Whether it’s an email course, a new iOS app, writing a book, or something else—a new project is just about as intoxicatingly novel as buying a new gadget.

3. Challenge myself to “no shopping” months

Starting with February, I’m challenging myself to not spend any money for the entire month that would be classified as “shopping” in my expense tracker. I’m going to track my success per day, so if I slip up, I can at least see how often I was able to stick to my plan.

4. Using a budget

I’ve never really cared for budgets before. I find them too restrictive and boring.

However, the expense-tracker I use on my phone has budgeting features built-in. You can set an overall budget, as well as budgets for different categories. I have a couple of category budgets set up for groceries, eating out, and shopping, as well as an overall budget. The problem is, I never really use the budgets—they’re just there.

The overall budget is the most important one, and I want to start paying more attention to it. Instead of spending blindly, I need to watch my budget and make sure I’m not spending more than I can afford each month.

5. Tracking my finances more carefully

I’ve been using a notebook to stay organised lately, so I’ve started using it to track my finances as well.

I came up with a visual layout for my notebook to keep track of my expenses and my income. My income is sporadic at the moment, since I’m earning money from various clients on different schedules and from the email course I just released.

The layout I made in my notebook helps me track income from the bottom up and expenses from the top down. My hope is to make sure each month my income keeps growing beyond the middle point (which is my minimum income needed), and my expenses don’t.

I’m hoping visualising my expenses on paper will make it more obvious when I’m overspending and where I can cut back.

A year is a long time. I have no idea how successful I’ll be at this challenge I’ve set for myself. But I hope if I can learn to be more mindful about spending money, a year will be long enough to get out of the bad habits I have right now.

I’m also going to come back to the list as the year goes on and try incorporating some more of the suggestions I found in my research. I’ve already started a need/want/wish list. I’d like to try paying myself an allowance for shopping and sticking to it, and the “spend a little, save a little” approach. But for now I think this is plenty to be going on with!

Subscribe Keep up to date with the Exist blog. Delivered to your inbox.